Not Guilty: Calvin Coolidge

By the Editors

This article appears in the Winter 2025 issue of the Coolidge Review. Request a free copy of a future print issue.

The causes of the Great Depression are an empirical matter. Still, scholars often present the Depression as a parable of good and evil. Calvin Coolidge is cast as a villain, a president whose deeds and words misled Americans about the strength of the 1920s markets and ushered in a decade of darkness.

Even star economists are not above locking Coolidge into this role. Consider what Nobel Prize winner Robert J. Shiller told a Yahoo! Finance interviewer in 2019. “Unfortunately Calvin Coolidge is not the example we want for good government because it all came crashing down in 1929,” Shiller said. “Was that his fault? I kind of think it was his fault.”

In his book Narrative Economics, Professor Shiller makes a related charge: that President Coolidge “took it upon himself to boost public belief in the economy and in the stock market.”

While not particularly analytic, the targeting of Coolidge would be warranted if the facts supported a guilty verdict. They don’t. Coolidge policy emphasized lowering burdens on business, precisely the shift that economists of both right and left agree postpones recessions or renders them milder.

What about the charge that Coolidge misled the country by talking up the economy and, especially, the stock market? This charge matters for reasons greater than Coolidge’s rank in presidential polls. A false accusation stains the reputation of good policies that would be useful today.

THE INCRIMINATING QUOTATION

The scholars who published in the 1950s, 1960s, or 1970s can be forgiven for crediting the “talk up” charge. The main stock index, the Dow Jones Industrial Average, rose from below 100 when Coolidge became president, in 1923, to 381 in the late summer of 1929. This increase was so out of line with what markets did in the 1950s or 1960s that it elicited disbelief and extraordinary explanations.

Midcentury academics also labored with limited sources. For decades the best available reports of Coolidge’s comments on the market came from Coolidge’s successor, Herbert Hoover. In a 1952 edition of his memoirs, Hoover recalled that in 1929, when stocks were already trading at treble recent levels, Coolidge stated that the prosperity of the country was “absolutely sound” and that stocks were “cheap at current prices.” This disconcerting quotation appeared three years later in a book by John Kenneth Galbraith, The Great Crash, 1929. Since then The Great Crash has become a standard college text, thereby etching in a caricature of Coolidge as out of touch with reality.

In recent years, however, the miracle of digitization has given us wider access to primary documents, including transcripts of the president’s off-the-record press conferences. The press conferences and other documents neglected in the past suggest that the newsmen of the 1920s misrepresented President Coolidge’s statements. So, too, did Hoover.

To see why, it helps to start by considering the mindset of that period. In those days, federal law did not dictate that Washington oversee the peacetime stock market. There was no Securities and Exchange Commission. New York State policed the New York Stock Exchange; Massachusetts, the exchange in Boston. The infamous fraudster Charles Ponzi operated in Massachusetts, among other states. As governor of Massachusetts in 1920, Coolidge—not President Woodrow Wilson—led post-Ponzi reform efforts.

As president, Coolidge followed the Constitution and statute, and played a different role. The job of the chief executive in Washington was not to regulate financial markets but to let the Federal Reserve or the Treasury do its work. In Coolidge’s view, when the market crashed, it crashed, and there was little a president could or ought to do. After all, men and women in their fifties—Coolidge’s age—had seen multiple market crashes in their adulthood. Those crashes were all followed, within a few years, by recovery. When it came to domestic markets, a president might provide information, but not much more. Coolidge operated according to a maxim he later outlined in his Autobiography: “The words of the President have an enormous weight and ought not to be used indiscriminately.”

To adhere to this policy, Coolidge chose to conduct his press conferences off the record, allowing reporters to paraphrase without direct attribution. Reporter Charles Michelson later recalled, “Coolidge’s expedient was to avoid direct quotation but to clothe such news as he wished the reporters to publish with some authority.”

But here Coolidge’s policy backfired. Reporters then, as today, craved hot quotes and racy stories. Denied both, they used their license to paraphrase and inject drama into stories. As today as well, 1920s writers emphasized personality, glorifying or vilifying. The White House press pool of the 1920s glorified. They liked to present Coolidge as an incumbent superman.

Another Coolidge protocol widened the scope for mischief. Whether the reporters’ articles were accurate or false, the president did not comment on them. This assurance of presidential silence emboldened already aggressive correspondents: whatever they said, no one would contradict them.

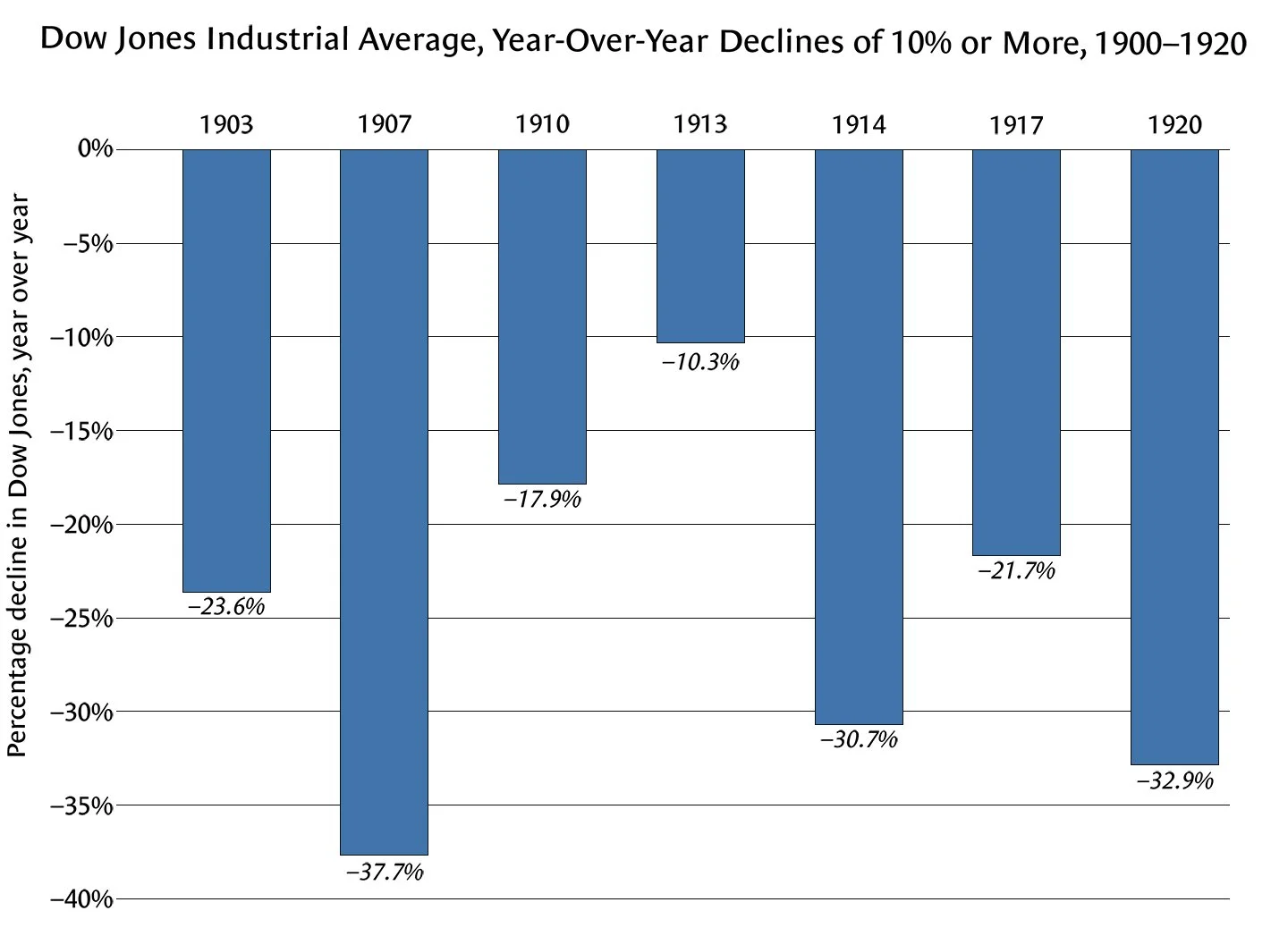

The Dow Jones Industrial Average fell by more than 10 percent year over year seven times in the first two decades of the twentieth century

(Source: DJIA Yearly Performance History, S&P Global)

WHAT COOLIDGE SAID

On December 6, 1927, Coolidge sent his annual message to Congress. He rated the state of the union “good” but warned that those eager to expand federal spending must understand that “a slight depression in business would greatly reduce our revenue.”

Later in the month, the Dow Jones Industrial Average closed past 200 for the first time and stayed around that level into January. The New York Stock Exchange reported that brokerage loans had risen sharply, a disconcerting sign that the few Americans who invested in stocks were overextending themselves.

On January 6, 1928, Coolidge took the unusual step of uttering a few calming words. “The number of different securities that are dealt in on the stock exchange are very much larger than they were previously,” the president told his press pool. He added, “Now, whether the amount at the present time is disproportionate to the resources of the country I am not in a position to judge.” But Coolidge allowed that he had not had “any indications that the amount [of brokers’ loans] was large enough to cause particularly unfavorable comment.”

The papers spun Coolidge’s equivocation as presidential certainty: “Sees Nothing Unfavorable in $3,810,023,000 Advances to Brokerage Houses,” read the subheadline in the Washington Post. When a secondhand version of Coolidge’s words became known, trading volume on Wall Street became heavy. On the subject of the press conference comment, Coolidge biographer Claude Fuess wrote, “It was the one important occasion when Coolidge did not keep his mouth shut, and his untimely utterance proved to be the most unfortunate blunder he ever made.” But Coolidge’s words may not have had as profound effect on traders as Fuess suggests. The Dow soon fell below 200 and stayed there most days for another two months.

In any case, Coolidge dropped market chatter and returned to his statements about Main Street. Typical were remarks on March 20, 1928: “There are a few more people that are out of work, or were when [the secretary of labor] made his survey, than there are at some other times, some places that have some unemployment, other places where it is not possible to secure the amount of labor that is desired.”

The same dry tone could be heard when, in late April, Coolidge told the press that the rest of the world was benefiting from “stabilization that has come from their getting their finances into better order and securing reforms in their currency, getting back onto a gold basis and stabilizing their currency.”

Still, the market kept rising through 1928. In August, The Atlantic published an article by economist Ralph West Robey headlined “Capeadores in Wall Street.” The term capeadores refers to the men in the bullring who wave their capes to excite the bull. The article suggested that President Coolidge and his administration were capeadores energizing a bull market. The New York Times picked up some of this article—and Professor Shiller would cite the piece more than ninety years later to support his contention that Coolidge talked up the stock market.

As the market moved further into uncharted territory, Coolidge privately expressed concern. Late in his presidency, he met with fellow Amherst alumnus Charles Merrill, the founder of Merrill Lynch. According to Merrill biographer Edwin J. Perkins, Coolidge and the financier agreed that share prices had to come down significantly. But Coolidge still rated presidential intervention in the market the wrong action.

As Dean W. Ball reports, Coolidge’s personal investments do not suggest a man preparing for a crash. His purchase of stock in a consumer goods company could be perceived as a hedge against recession, but the case is hardly definitive. Regardless, Coolidge ended up selling the stock at a big loss.

PROSPERITY “CAN EASILY BE LOST”

In the last few months of 1928, Coolidge continued to remark on business conditions generally rather than Wall Street specifically. Here again, though, reporters listened selectively and exaggerated.

On October 30, days before the presidential election, Coolidge briefly discussed the economy:

Our imports are keeping up, especially are our exports keeping up. The exports of course do not bring us in direct revenue, but if exports are large it is an indication that business is good and profits will accrue on which the Government will collect income taxes. The general business condition of the country seems to be remarkably strong.

“Remarkably strong” clearly referred more to industry than to financial markets.

Coolidge made these comments as he discussed a favorite subject: the importance of maintaining a balanced budget. Noting that “the [tax] receipts of the Government depend very largely on the business conditions,” the president expressed cautious optimism that the federal government would once again avoid a deficit.

Coolidge understood that a presidential election could give markets jitters. Commenting on the general economy, he said, “The foundation of it must be particularly secure not to be shaken at all by the occurrence of a presidential election.” Coolidge considered a balanced budget an important foundation for a sound economy, one that could help render any market disturbance short-lived.

President Coolidge added a characteristically qualified statement about American business conditions: “All indications that we get seem to show that business is somewhat better on the whole than it was a year ago.”

The press did not emphasize the president’s measured words or his focus on industry. Instead, reporters hyped the most positive statement in his preelection remarks. “Conditions Give Coolidge Joy,” read the Los Angeles Times headline. Never mind that Coolidge’s joy, if any, probably derived from the fact that his party was doing well and that he would soon retire to Northampton, Massachusetts.

In a November 1 editorial headlined “Invulnerable Prosperity,” the New York Times wrote, “When business conditions in this country are represented by President Coolidge as sound beyond the ability of a national election result to affect them adversely, the comment comes from the chosen expert of the business world.” The careless reader would assume Coolidge had called the economy invulnerable. He had not.

On December 4, Coolidge used the occasion of his State of the Union address to observe, “The country is in the midst of an era of prosperity more extensive and of peace more permanent than it has ever before experienced.” But he quickly added a warning: “We should not fail to comprehend that it can easily be lost.”

Note what is missing from the president’s recorded economic remarks in his second term. Where is Coolidge’s 1929 statement that American prosperity was “absolutely sound” and that stocks were “cheap at current prices”?

Perhaps new archival finds will deliver up the comment. But at this writing, we find no evidence of the “cheap at current prices” statement in the press conferences or newspaper archives.

THE URGE TO BLAME

The press’s hype contributed to Coolidge’s reputation as a stock market booster. But this alleged quotation about “cheap” stock prices has cemented the view. As noted, Herbert Hoover quoted Coolidge making this statement in 1952. Hoover’s recollection mattered, especially after John Kenneth Galbraith cited it in his influential book a few years later.

But Hoover may well have made an error, as his biographer George H. Nash has pointed out.

Hoover lived for three decades after his bitter single term in the White House, composing multiple volumes of his memoirs. An account of events in 1929 that Hoover wrote out by hand in the 1940s contains the following line: “My situation was embarrassed by a press statement of Mr. Coolidge a few days before he left office assuring the country that its apparent prosperity was absolutely sound [and] that stocks were cheap in the market.”

But when Hoover published the third volume of his memoirs, he converted paraphrase into direct quote, attributing to Coolidge the comment that prosperity was “absolutely sound” and stocks “cheap at current prices.” This drift suggests that Hoover inadvertently convinced himself that Coolidge had uttered words that the thirtieth president had not.

Herbert Hoover’s handwritten recollection of a comment on the stock market that Coolidge supposedly made in 1929. Note the lack of direct quotation.

Hoover may have made a second slip in his dating of the controversial quotation. A review of the primary-source record produces no 1929 statements by Coolidge offering strong assurances about the stock market. The closest one can find is Coolidge’s calming comment issued in January 1928. In other words, Hoover may have misremembered the date by at least a full year.

The timing matters because the stock market in early 1928, though high, might still have been considered a good investment. By 1929, however, the Dow Jones Industrial Average had risen another 100 points—a stunning 50 percent increase in just a year. “Cheap” would have become a more daring claim.

Hoover’s apparent misdating slipped as fact into Galbraith’s much-quoted classic. And so on, into a thousand textbooks.

Which leaves us with a question: Why did Hoover, and so many others, find such value in the purported Coolidge line? The answer may indeed be that the Great Depression encourages our tendency to turn history into parable. The urge to blame someone, anyone, feels almost irresistible. Still, emotion should not stop us from representing facts as accurately as we can.

This article appears in the Winter 2025 issue of the Coolidge Review. Request a free copy of a future print issue.