Here’s How the U.S. Can Tackle the Debt Crisis

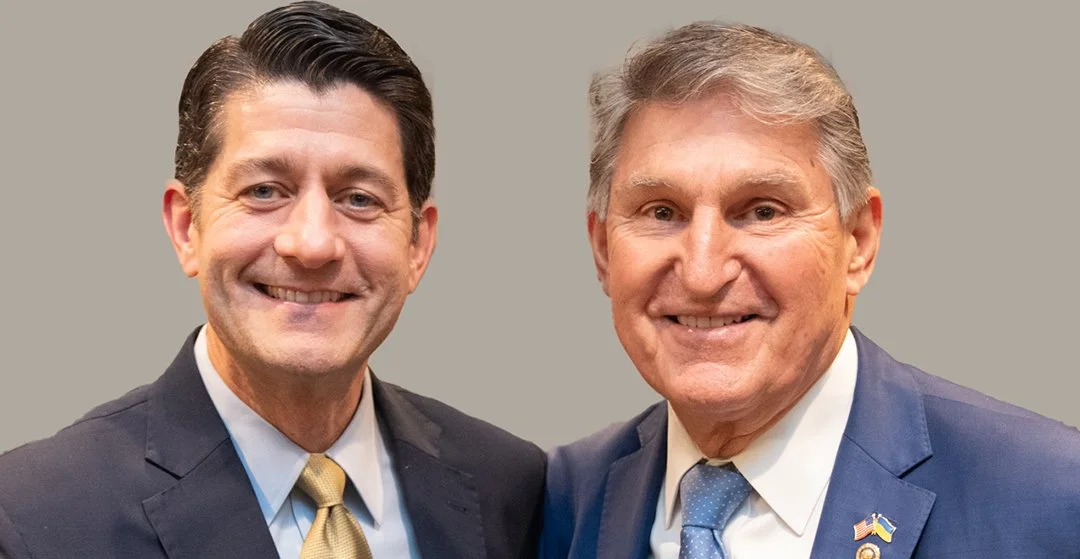

Former Speaker of the House Paul Ryan and Senator Joe Manchin at the Coolidge Foundation’s “America in Debt” conference

By Joe Manchin, Romina Boccia, Paul Ryan, David Malpass, and Steve Forbes

The following reflections on the U.S. debt crisis—and how to solve it—appear in the Summer 2024 issue of the Coolidge Review. Request a free copy of a future print issue of the magazine.

The national debt recently soared past $35 trillion, and trillion-dollar annual deficits (at least) have become the norm in Washington.

But you don’t hear many politicians address the sea of red ink in which the government is drowning—even though two major credit-rating agencies have downgraded the creditworthiness of U.S. debt.

In the 1920s, President Calvin Coolidge slashed the debt by about a third and became the last president to cut the size of government. Biographer Amity Shlaes explains why Coolidge succeeded where subsequent presidents have failed:

“Coolidge understood that lifting the debt burden starts with winning the trust of the electorate. He spoke to voters as adults. He explained why economy—government saving—would be beneficial to voters. Coolidge, and President Harding before him, poured energy into conveying this message.”

Not content with lobbying the public, they also endeavored to rally federal employees to the cause of debt reduction. General Herbert Mayhew Lord, budgetmeister under Harding and Coolidge, led meetings of federal employees that were more akin to Boy Scout jamborees or pep rallies than traditional meetings. He awarded prizes to those employees who cut the spending in their departments most aggressively.

So what can the United States to confront its debt crisis today? Here, several leading figures offer their insights:

If we don’t do something, all these young people today aren’t going to make it. We’re writing checks that you can’t cash. We’ve got you upside down, and it’s all our fault. We haven’t done anything about it.

We’ve been trying. We had the Simpson-Bowles Commission. It was an absolute road map of what we should have done a long time ago, and we didn’t do it because of politics.

We’ve got an opportunity right now with the Fiscal Stability Act to put our trajectory on a downward slope, so this will be great for your generation and your children and grandchildren, and we need to do it. And we’re going to have to have all hands on deck.

—SENATOR JOE MANCHIN of West Virginia

There is one approach to the debt crisis that Congress has not yet tried. And that is modeling a fiscal commission after the successful Base Realignment and Closure Commission, or BRAC.

BRAC was a process to identify obsolete military bases following the end of the Cold War. It established an independent commission to help Congress overcome the apparently intractable political challenge of making decisions that involve concentrated costs and dispersed benefits. It was clear to all that keeping costly military bases that were no longer needed was contrary to the national interest. And yet legislators would fight tooth and nail to keep bases open in their jurisdictions. So they set up BRAC. It succeeded and saved federal taxpayers billions.

Our best hope lies in members of Congress acknowledging that they abdicated their responsibilities to control federal spending a long time ago. An independent BRAC-like fiscal commission would put in place a workable mechanism to get the job done.

—ROMINA BOCCIA, Cato Institute

Health and retirement security and a safety net for those who slip through the cracks are things we all need and want to preserve. But the system was designed in the twentieth century in ways that are totally unsustainable in the twenty-first century.

The question is, what will force us to get political people into the room to address the crisis? I never really liked commissions; I always thought a commission was Congress ducking its own responsibility. But honestly, I think we’re at the point where a commission is the only choice we have. We’ve got to have a commission with teeth.

—PAUL RYAN, former Speaker of the House

For forty years in Washington, people have said, If only politicians had backbone, we could get at the budget deficit problem.

We have to give up that idea. Politicians are paid to spend money; that’s how they get reelected.

We have to think in terms of changing the rules. We need a much stronger debt limit than the threat of default. We need a new check and balance on the size of government.

The idea would be that whenever the ratio of marketable debt to gross domestic product exceeds 100 percent, the federal government faces harder restraints on both spending and taxation. Washington has to feel most of the pain—not the country, not the global financial markets.

Of course, Washington will never do this by choice. We have to go to the public and say, Don’t you want Washington’s size and wealth to be limited? Otherwise your destiny is to work the rest of your life for Washington.

—DAVID MALPASS, former World Bank president

To have sustained economic growth over time, you need a stable value for the dollar.

We’re not going to return anytime soon to the gold standard, but there are other ways to maintain a fairly stable monetary system. From the mid-1980s to the late 1990s, the Federal Reserve had what you might call a sloppy gold standard. They looked at commodity prices to see what the marketplace was saying about the value of the dollar. And that was a pretty good growth period.

Then the Fed went in the opposite direction. That’s when the price of oil jumped from twenty dollars a barrel to more than a hundred.

The key is, the Fed should stop trying to manipulate the growth of the economy. How in the world can a few Fed governors and three hundred PhDs in Washington control the economy? Leave it alone.

—STEVE FORBES, chairman of Forbes Media, author of Money